Singapore Institute of Advanced Medicine Holdings Ltd

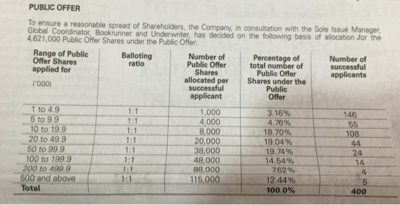

Singapore Institute of Advanced Medicine Holdings Ltd ("Sam" or the "Company") is offering 114m new shares comprising 4.415m Public Offer Shares and 109.585m Placement Shares at $0.23 each for a listing on Catalist. The Company aims to raise $26.2m and the majority of the proceeds will be used to repay debt and the balance for working capital. The market cap based on the IPO price is $231.8m and the offer will close on 14 Feb at 12 noon and starts trading on 16 Feb 2024 at 9am. Principal Business SAM is a healthcare service provider using advanced technology for early and accurate diagnosis to detect and treat cancer, neurodegenerative and cardiovascular diseases. SAM has strategic collaborations with public and private institutions for research and clinical work. SAM's goal is to create a comprehensive one-stop ambulatory cancer centre to undertake the challenges to fight cancer and is one of the first to adopt proto beam therapy treatment in Singapore. Fi