Yesterday was an interesting day.

You had Geo Energy listing at 9am and Religare at 2pm.

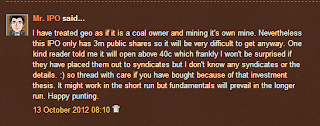

Geo Energy

From a fundamental angle, after i gave

Geo Energy a chopped chilli, there was a kind reader who emailed me to tell me that Geo is actually a 3 Chilli. Obviously, he knew of things that i don't. In fact, he also told me the subscription rate and the opening price one day before the listing. hahaha... Power. I call it the power of placement and i have shared that conversation with you prior to its close.

Some underwriters have the ability to place it to 'strong hands' and 'syndicate group'and you can actually get some hints from the prospectus when you see who the placement agents or underwriters are.

To have such a successful debut, you need to have a smaller size issue and limit the number of shares issued to the public, hence the number of shares will be low and it will be very difficult to get. Read the balloting post

here. It is interesting the Geo Energy came out with a news release to boast about its robust debut. hahaha quite rare to see such announcements. The announcement is

here. Geo closed at $0.435 (up 33.85%)

Religare Health Trust

On the other hand, Religare has been flip-flopping on its news. First it priced its shares at the lower end of the book building and at the same time, moved its debut from 22 Oct 9am to 19 Oct 2pm. I am not sure if they know the US market will crash on Friday night but thankfully they did that! Otherwise i will suffer a big loss on its debut. I have shared with you my thoughts on

Religare. The thing about big issue is that it is very difficult to control the placement.

Some readers asked me why i have IPO shares that are forced down my throat. This is because i have signed an agreement to take all the IPOs which they underwrite subject to a certain limit and for a time period. It is like doing National Service. You can't pick and choose. One 'naughty' reader asked me to write a post about my losses from Religare and I will kindly oblige her.

I have 25 lots from the placement tranche, hence i have to pay 1% extra placement commission but the thing about me as i have shared with you is that i know when to move on. I cut it within 15 mins of the opening since i don't like the counter in the first place. My loss will be about $500, will report the actual loss next time if i decide to do a

report card on my IPO tikams like previous time. Religare closed at 10% down to 81c.

Gaylin Holdings Limited

The next IPO to debut will be

Gaylin which will debut on 25 Oct. I really don't understand why they have to close the IPO on 23 Oct at 10am instead of the usual 12pm. Two sharp readers have pointed out the error to me and i have amended my post accordingly. Can someone enlighten me? Is it due to Fengshui?!?!

My biggest worry about Gaylin is actually the sentiments. Sentiments can flip flop very easily. I don't like what i am seeing on the US side with a bad closing on

Friday and the Volatility Index spiking up 13%. I just hope that CIMB, as the main placement agent, has placed out the issue to strong hands. In case you are wondering where i sourced my shares from, it was from the same placement agent as Geo Energy. It may be a good thing that my exposure was cut by 65% due to good demand.

Dynasty REIT

The next IPO i don't want to get

Dynasty REIT and hopefully i won't have too many shares forced down my throat.

The Naughty Reader

The same 'naughty' reader said that since I 'saved' her from Religare, she will 'not blame' me for not applying for Geo Energy... hmm... let's count the probability of that earnout.

Assuming i have $100,000, since i can't apply for both IPOs at the same time, i will split $50,000 Geo and $50,000 Religare and that i sold both at the closing price. Based on the balloting ratio, the probability earnout will look something like that.

Religare = $(0.81-0.90) x 23/50 (probability) x 9,000 shares = $372.60 (loss)

Geo Energy = $(0.435 - 0.325) x 8/99 (probability) x 8,000 shares = $71.10 (gain).

So in the end, i still managed to help saved the naughty reader $300 before commission using the probability earnout model. :-P

Happy IPOing and have a good weekend.

Comments

How do you manage to get placement from the banks?

You must be some star player in the IPO market. hahaha

Anw I am going in for 100,000 shares. My mum wants to apply 1,000,000 but last time we did that was Hu An Cable and ass CIMB dumped 64 lots on me, 250 lots on my mum, lose big $$$$. Mr IPO, will CIMB do that this time? How and what isthe 22m over allotment thing, can explain a little?

btw, waiitng for my friend's father is a private broker to give his take, will share soon.

If 22m over-allotment is triggered, means the owners will sell more shares from their pockets and then CIMB will use this 22m shares for stabilisation. If price falls below 35c, CIMB will buy back from the open market and return the shares to the owner. If not, owners will sell 22m shares as if they have divested lor.

With only 5m shares for public, I think should be "safe" la. won't have chance to dump unless we see a black Monday on wall street.